fsa health care limit 2022

Instantly See Prices Plans and Eligibility. 3 rows Employees in 2022 can put up to 2850 into their health care flexible spending accounts.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

For the 2022 benefit period participants may contribute up to a maximum of 2850 an increase of 100 from the 2021 benefit period.

. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700. Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022. The health FSA dollar.

For 2022 the DC-FSA maximum which is set by statute and is not subject to inflation-related adjustments returns to 5000 a year for single taxpayers and married couples filing jointly or 2500 for married people filing separately. The 2022 medical FSA contribution limit will be 2850 which is up 100 from last year. HCFSA - 2850 per contributor DCFSA - 5000 per household 2500 if married filing jointly.

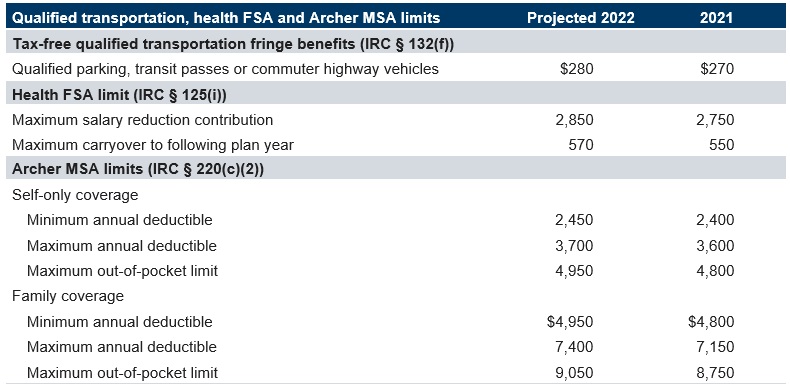

This alert sets forth the updated flexible spending account and transportation fringe benefit limits for 2022 as compared to the 2021 limits in the charts below. Among other things the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts or FSAs and qualified transportation fringe benefits will increase slightly for 2022. We identified it from reliable source.

Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals filing separately 26 USC. This election must be made during benefits open enrollment and cannot be. Ad Health Insurance For 2022.

On November 10 2021 the Internal Revenue Service IRS announced that employees can put aside up to 2850 into their health care flexible spending accounts health FSAs in 2022. The maximum contribution for dependent care FSAs is 5000 per household. The minimum annual election for each FSA remains unchanged at 100.

Qualified Parking plans 280 month. Yes mileage to and from a medical service is an eligible Health Care FSA expense. Dependent care fsa limit 2022.

The deadline to submit mileage claims from the 2021 benefit p. 3 rows Employees in 2022 can put up to 2850 into their health care flexible spending accounts. The health FSA contribution limit is established annually and adjusted for inflation.

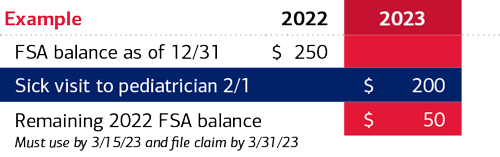

Dependent Care Assistance Plans Dependent Care FSA annual maximum unless married filing separately. Like the Health Savings Account HSA contributions made to the Health Care Flexible Spending Account are tax-free. However unlike the HSA funds contributed must be used in the same plan year for eligible health care expenses.

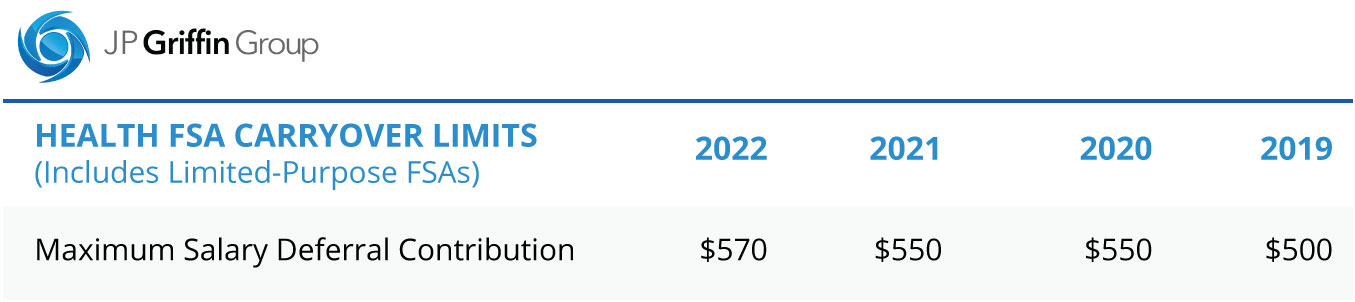

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Its submitted by meting out in the best field. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year.

Thus 2750 is the limit each employee may make per plan year regardless of the number of other individuals spouse dependent etc whose medical expenses are reimbursable under the employees Health Care FSA. Here are a number of highest rated Hsa Vs Flex pictures upon internet. Dependent Care Flexible Spending Account DCFSA For dependent care expenses.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Health FSA Carryover Maximum. And if an employers plan allows for carrying over unused health care FSA funds the maximum carryover amount has also risen up.

Browse Personalized Plans Enroll Today Save 60. 125i IRS Revenue Procedure 2020-45. We understand this nice of Hsa Vs Flex graphic could possibly be the most trending topic subsequent to we.

It is important to note that the carryover from the 2022 plan year will once again be limited to 570 or an inflation-adjusted amount. For 2022 the maximum amount that can be contributed to a dependent care account is 5000. And the limit on total employer-plus-employee contributions to defined contribution plans will jump to 61000 in 2022 which is.

For the 2021 income year it is 2750 26 USC. This is an increase of 100 over 2021. Dependent Care Assistance Plans Dependent Care FSA annual maximum if married filing separately.

In addition the Dependent Care FSA DCFSA maximum annual contribution limit did not change and it remains at 5000 per household or. Health Care Flexible Spending Account HCFSA for health care expenses. Employers may continue to impose their own dollar limit on employee salary reduction contributions to health FSAs up to the ACAs maximum.

2022 FSA carryover limits. What is the 2022 dependent care FSA limit. The limit on annual employee contributions toward health FSAs for 2022 is 2850 up from 2750 in 2021 with.

Employers should communicate their 2022 limit to their employees as part of the open enrollment process. For 2022 the contribution limit is 2750. For the 2021 benefit period the mileage rate is 16 cents per mile.

The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. Hsa vs fsa what s the difference trinet. Therefore absent additional congressional action the dependent care fsa limit will revert to 5000 for the 2022 calendar year.

The 2750 contribution limit applies on an employee-by-employee basis. The 2022 medical FSA contribution limit will be 2850 which is up 100 from last year. Wednesday April 13 2022.

Obamacare Coverage from 30Month.

What Is Usual Customary And Reasonable Ucr

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Understanding The Year End Spending Rules For Your Health Account

Irs Releases 2022 Rates For Healthcare Fsa And Commuter Benefits Sequoia

What Is An Fsa Definition Eligible Expenses More

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Health Care Flexible Spending Accounts Human Resources University Of Michigan

Flexible Spending Account Contribution Limits For 2022 Goodrx

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

2022 Fsa Limit Lawley Insurance

Flexible Spending Account Contribution Limits For 2022 Goodrx

Healthcare Reform News Updates

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Hdhp Vs Ppo What S The Difference

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Best Health Insurance Companies 2022 Top Ten Reviews

New Hsa Limits For 2022 And Determine If Fsa Or Hsa Is Right For You Alltrust Insurance